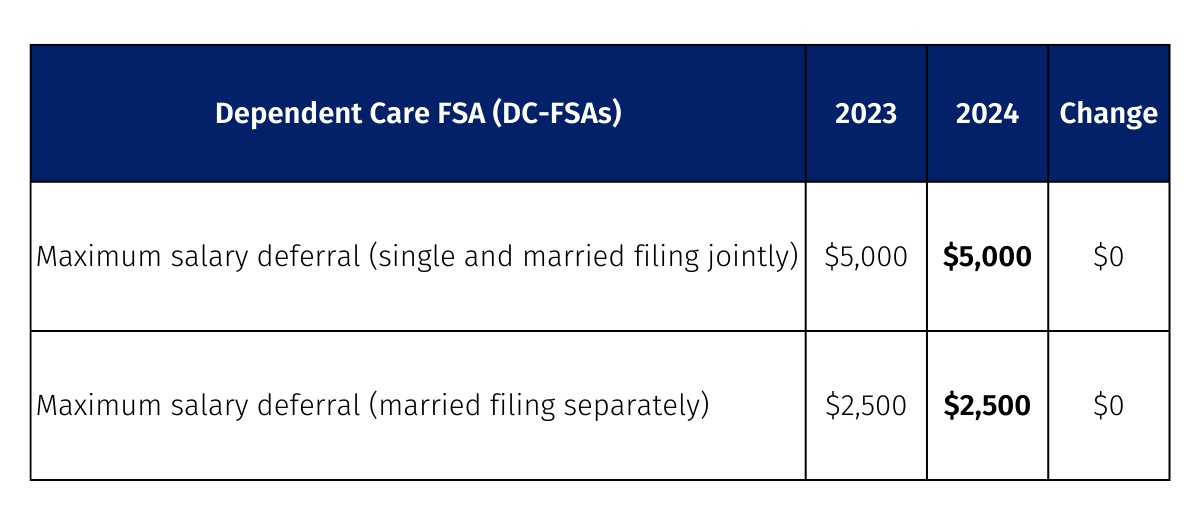

Dependent Care Fsa Limit 2024 Married. Generally joint filers have double the limit of single or separate filers. You can contribute up to $5,000 in 2024 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

The limits for 2023 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for the 2024 plan year. A married employee’s dependent care fsa.

Dependent Care Fsa Limit 2024 Married Images References :

Source: leshiawneala.pages.dev

Source: leshiawneala.pages.dev

Dependent Care Fsa Limits 2024 Married Claire Kayley, — washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Source: erinnpamelina.pages.dev

Source: erinnpamelina.pages.dev

Annual Dependent Care Fsa Limit 2024 Married Ray Leisha, You can elect to set aside up to $5,000 in the dependent care fsa for 2025 (up to $2,500 if married and filing separate federal tax returns).

Source: anniceannalise.pages.dev

Source: anniceannalise.pages.dev

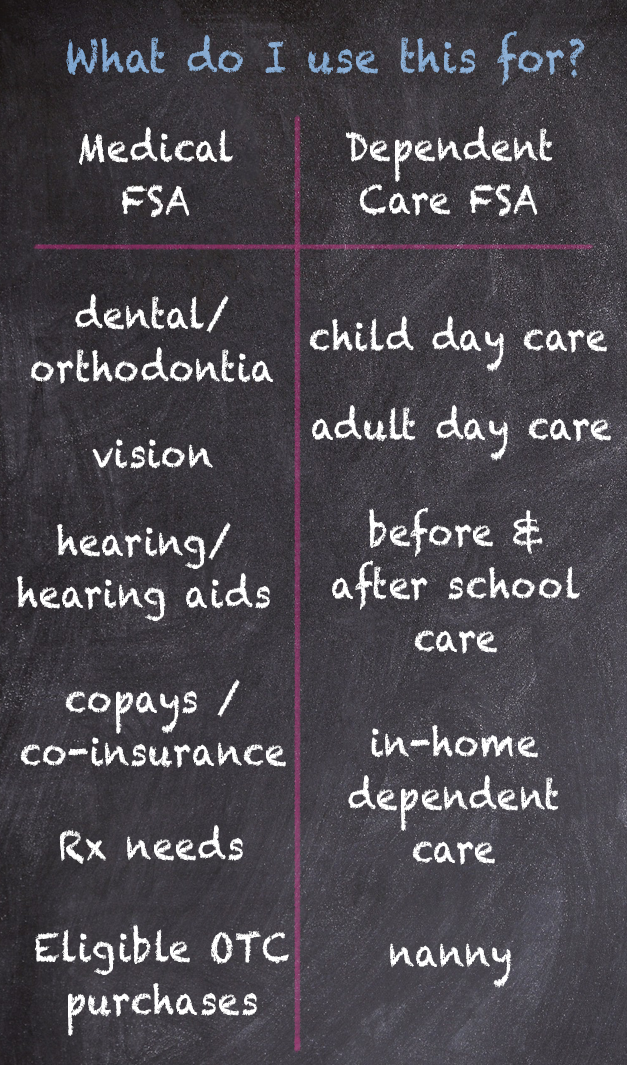

Dependent Care Fsa Contribution Limit 2024 Married Kayle Melanie, What is a dependent care flexible spending account?

Source: anniceannalise.pages.dev

Source: anniceannalise.pages.dev

Dependent Care Fsa Contribution Limit 2024 Married Kayle Melanie, Here's a breakdown of dcfsa contribution limits:

Source: myrnabpeggie.pages.dev

Source: myrnabpeggie.pages.dev

Dependent Care Fsa Contribution Limits 2024 Married Jointly Nell Tarrah, The limits for 2023 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for the 2024 plan year.

Source: erinnpamelina.pages.dev

Source: erinnpamelina.pages.dev

Annual Dependent Care Fsa Limit 2024 Married Ray Leisha, Generally joint filers have double the limit of single or separate filers.

Source: elwirabterrie.pages.dev

Source: elwirabterrie.pages.dev

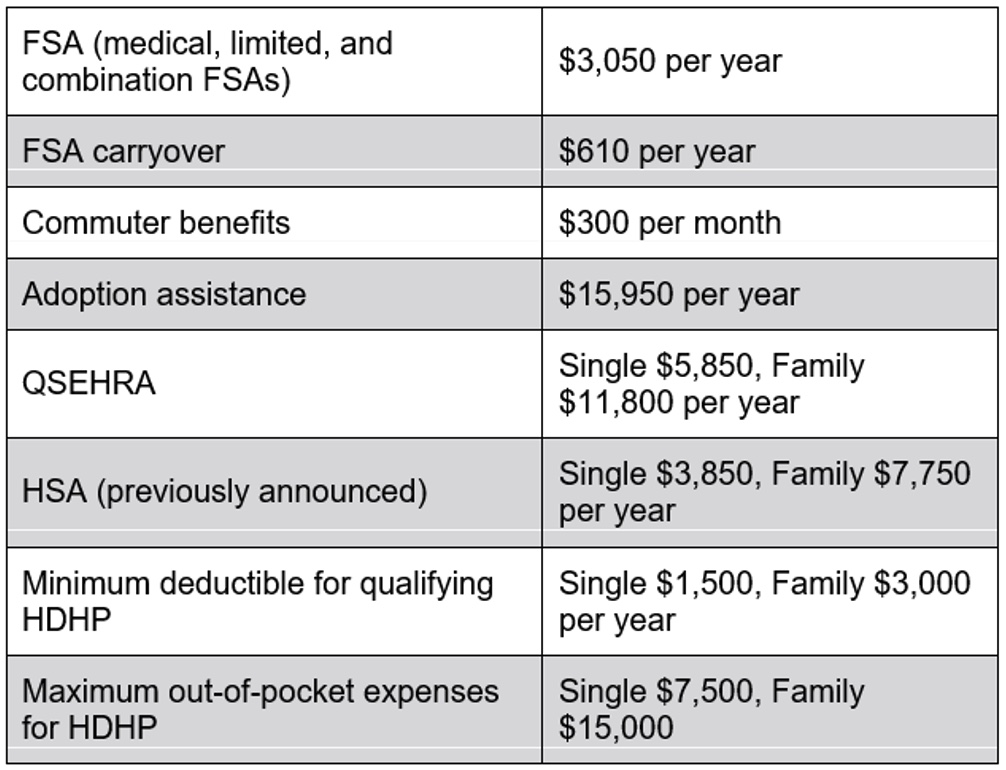

2024 Fsa Contribution Limits For Married Couples Livy Sherye, You can also use an fsa to pay for qualified expenses for your dependents and your.

Source: terribnatassia.pages.dev

Source: terribnatassia.pages.dev

Dependent Care Fsa Contribution Limit 2024 Calculator Lotty Riannon, — if you and your spouse are divorced, only the parent who is the primary caregiver can contribute to a dependent care fsa.

.png) Source: laceypattie.pages.dev

Source: laceypattie.pages.dev

Dependent Care Fsa Contribution Limit 2024 School Leann Aindrea, $5,000 for single, unmarried individuals.

Source: dauneyalonda.pages.dev

Source: dauneyalonda.pages.dev

Dependent Care Fsa Contribution Limit 2024 Catch Up Sonni Cinnamon, — during open enrollment in health care fsas or dependent care fsas, employees must weigh these limits against what they expect to spend on eligible expenses.